This proactive method ensures accuracy in each budgetary reporting and monetary management. This entry displays the discount or elimination of the preliminary encumbrance, making certain that the price range precisely reflects the up to date dedication or the discharge of funds in case of cancellation. Maintaining these adjustments is essential for correct price range management and for preventing overspending or mismanagement of public funds. With Out an encumbrance system, authorities entities could inadvertently spend greater than what has been allocated, resulting in potential price range shortfalls. Encumbrances stop this by recognizing commitments as quickly as they are made, earlier than the actual money outflow happens. This ensures that the entity doesn’t overspend its budget, maintaining financial discipline and compliance with authorized spending limits.

Iris Insurance: What It Is, Companies Supplied, And Why It Stands Out

Their primary responsibility lies in accurately recording and managing encumbrances inside the organization encumbrance accounting‘s accounting system. Governmental funds, such as general funds and special income funds, typically make the most of encumbrance accounting to regulate spending and make positive that sources are used for their meant functions. Encumbrance data allows budgetary control, letting your company higher perceive where they’re financially at any given time. Since the cash that the company will spend later is tracked, an organization can keep from overspending. By making seen the amount of cash you intend on spending sooner or later, you can extra accurately see how a lot cash you’ll be able to spend on future projects or purchases without going over budget.

By actively managing encumbrances, government officers demonstrate their commitment to accountable stewardship of public funds. Authorities officials, including elected officers and appointed administrators, bear the last word accountability for overseeing the financial well being of their organizations. By integrating encumbrances into the budgeting process, finances analysts contribute to sound financial planning and control. Price Range analysts are instrumental in creating and monitoring the group’s budget. Encumbrances are a key consideration in their work, as they represent future monetary commitments.

This idea is most commonly used in governmental and nonprofit accounting, although it can be utilized in some enterprise settings. It’s typically utilized in relation to budgeting and expenditure controls, ensuring that a certain amount of cash is put aside to cowl anticipated prices. For instance, if a government entity decides to minimize back the quantity of products ordered or negotiate a lower cost, the preliminary encumbrance would be too excessive. In this case, the entity would scale back the encumbrance to match the up to date purchase order or contract worth. Conversely, if a purchase order order is canceled totally, the encumbrance have to be totally reversed, releasing the reserved funds again into the available finances.

Key Rules In Accounting For Encumbrances Underneath Gasb (governmental Accounting Standards Board)

Under GASB requirements, encumbrances are not thought-about liabilities, as no actual payment or transfer of products or companies has taken place. Instead, they’re a part of budgetary control, making certain that funds are reserved and available for dedicated bills. The treatment of encumbrances is guided by GASB Assertion No. fifty four, which outlines how governments ought to classify and report fund balances, including these funds which might be restricted, committed, or assigned. When a government entity issues a purchase order or indicators a contract, it creates a future obligation to spend funds, despite the precise fact that the actual fee could not happen until the products or companies are delivered. To reflect this commitment in the accounting system, the government uses encumbrance accounting to reserve funds for the longer term expenditure. Encumbrances play a vital position in ensuring that funds can be found for committed bills.

If they approve a $200,000 highway repair contract, that quantity turns into an encumbrance—reserved within the books—even although no cash has been spent yet. Furthermore, many state and local legal guidelines mandate the use of encumbrance accounting, solidifying its position as a regular apply. They also https://www.quickbooks-payroll.org/ help stakeholders perceive the connection between planned expenditures and precise financial commitments.

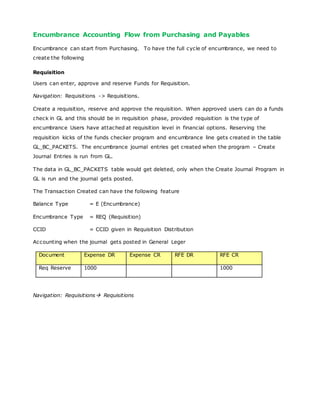

This intent implies that the enterprise is extremely more likely to spend money in the future, which suggests a dedication to make a purchase order. Encumbrance accounting consists of recording encumbrances within the common ledger when the group is particular in regards to the time and quantity of the anticipated expense. This is completed earlier than creating and collecting the underlying paperwork, similar to purchase requisitions and purchase orders. Obligations – Accounting related to funds that characterize obligations to pay (encumbered). When Sue updates theencumbrances, solely two-thirds of the wage and employer-paid expenseshave to be encumbered to have sufficient funds encumbered for theyear, for a whole quantity of $19,200. Commonly used in authorities, public sector, and nonprofit entities, encumbrances help organizations handle and forecast budgets effectively.

As Soon As the products or services that were ordered are obtained, the encumbrance should be reversed to mirror that the commitment has now been fulfilled. The authentic encumbrance was a budgetary placeholder, so now that the expenditure is in a position to be acknowledged as an actual value, the encumbrance is no longer wanted. Now that we now have explored the advantages of encumbrance accounting, let’s think about its limitations.

These commitments are recorded in budgetary accounts, not within the primary monetary statements. Nevertheless, when a portion of the budget is encumbered, it reduces the unassigned fund steadiness in the governmental fund’s monetary reporting. This implies that though the encumbered amounts aren’t actual liabilities or expenditures, they scale back the portion of the fund balance that’s obtainable for brand spanking new spending. Year-end encumbrances are carefully managed to ensure that funds are reserved for future commitments and that financial obligations are correctly recorded. In budgetary accounting, encumbrances are carried ahead into the next fiscal 12 months, while in monetary accounting, liabilities are accrued when goods or providers are obtained.

- This strategy enhances fiscal accountability and ensures that stakeholders have a transparent understanding of how much of the government’s budget is already allocated to future spending.

- As Quickly As the bill has been acquired or paid, the original encumbrance transaction is reversed, and the expense is recorded as regular.

- These examples illustrate how encumbrances are utilized in varied situations to trace and handle financial obligations.

- This sort of accounting additionally helps detect fraud, prevent rampant spending, and will increase finances management.

After the seller accepts the purchase order and delivers the products or providers, the buying group becomes liable to make the payment. On the opposite hand, a non-financial encumbrance might be an easement, which is a right given to a third celebration to employ certain areas of a property. In any of these situations, an encumbrance would possibly restrict the possibility to switch the property or it may also diminish its worth, because of the declare. There are also some conditions where authorized actions in opposition to the property owner are thought of encumbrances.

Buying agents provoke the encumbrance course of by creating buy orders for goods or services. While GASB is the primary standard-setter, different organizations and sources can affect encumbrance accounting practices. GASB requirements tackle the specific considerations related to encumbrance accounting within the context of fund accounting. GASB offers steering on numerous elements of encumbrance accounting, making certain that monetary info is offered fairly and precisely.