Be A Part Of the 50,000 accounts receivable professionals already getting our insights, finest https://www.personal-accounting.org/ practices, and tales every month. The current greenback quantity of open invoices, based mostly on days for the rationale that invoice date. So, the finest way to cater to the comfort of a broad range of customers is to offer a wide range of cost methods.

This means the AR is just turning into bankable cash three times a year, or invoices are paid on average every 4 months. A high accounts receivable turnover ratio usually means your customers pay on time. It additionally exhibits your credit collection process works nicely and you have got fewer unpaid bills. The receivables turnover ratio might help a company understand its existing cash move trend.

A higher turnover ratio also illustrates a greater cash flow and a more sturdy balance sheet or earnings statement. Your company’s creditworthiness appears firmer, which can help you to acquire funding or loans quicker. The accounts receivable turnover ratio is essential for businesses striving to speed up their money flow through excellent firm credit insurance policies and accounts receivable management. As Quickly As you realize your accounts receivable turnover ratio, you ought to use it to determine what number of days on average it takes prospects to pay their invoices (for credit sales). A greater receivable turnover ratio indicates that an organization collects its accounts receivable extra incessantly throughout the year.

Versatile payment strategies improve collections by catering to diverse customer preferences, giving them the chance to pay extra promptly. Common reviews of your automated AR processes assist determine and remove bottlenecks, additional optimising your cash move. These techniques also produce stories on outstanding invoices, enabling you to prioritise assortment efforts. Right Here, web credit score gross sales refers to gross sales made on credit, minus any returns, discounts or allowances. A wholesome ratio allows for better financial planning and reduces the risk of money move shortages. Gleaning insights from their success stories may help you chart a course for your company to potentially replicate their achievements in strong AR ratio administration.

Every Thing You Want To Grasp Financial Modeling

Both ratio formulae are related, but their implications are very totally different. You must evaluate your AR turnover ratio to related firm ratios in your sector. Contemplate factors similar to working capital construction, share of credit score gross sales, and cost terms when evaluating ratios.

Make It Straightforward To Pay

If this is the case, you may want to hire additional collection staff or analyze why your receivables turnover ratio worsened. Like any enterprise metric, there is a limit to the usefulness of the AR turnover ratio. For example, collecting a payment for office supplies is much simpler than accumulating receivables on a surgical procedure or mortgage fee. A consistently low ratio signifies a company’s invoice phrases are too lengthy.

- This is also known as the effectivity ratio that measures the company’s capacity to gather income.

- Plus, a positive AR turnover ratio could not necessarily be good for the enterprise.

- Speedy stock turns and every day receipts cut back the necessity for big buffers.

- By employing the receivables turnover ratio formula frequently, maybe quarterly, companies can keep knowledgeable and agile in managing their credit score policies accordingly.

- A ‘good’ Accounts Receivable Turnover Ratio is generally excessive, indicating effective assortment processes and a short assortment interval.

Gather totals for current assets and current liabilities from the steadiness sheet. Affirm line objects match prior intervals and reflect solely gadgets due inside yr. If a company can collect money from clients sooner, will in all probability be ready to use that cash to pay bills and other obligations sooner. Simply as you can not infer much from the turnover worth alone, you also can’t make predictions of your company’s profitability or effectivity should you don’t maintain monitor of the turnover over time.

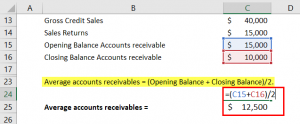

In the above instance, your accounts receivable ratio of 10.5 means you’re changing your receivables to money 10.5 instances over the given 12 months. The next step is to calculate the average accounts receivable, which is $22,500. Web credit sales are calculated as the total credit sales adjusted for any returns or allowances. Decide the Closing Accounts Receivable- The closing accounts receivable is the stability at the finish of the period you may be analyzing.

Even although the accounts receivable turnover ratio is essential to your business, it has limitations. For instance, certain companies (grocery stores) might have high ratios because they’re cash-heavy, so the AR turnover ratio may not be a good indicator. Utilizing automated AR software program can make accounts receivable turnover ratio formula it easier to invoice your customers and ensure they pay on time. Clear and detailed invoices are extra manageable in your prospects to read and understand.

The beginning accounts receivable is the quantity of receivables initially of the period, whereas the ending accounts receivable is the amount on the end of the interval. This blog delves into the calculation and examples of this vital financial metric for companies. Stock research agency CSI Markets revealed data throughout several industries in 2022.