The accrual-basis income statement reveals your revenue as it’s earned and your expenses as they’re incurred. If you bill your customers they usually pay sooner or later in the future, the income is technically earned whenever you invoice them, not once they pay you. An accrual-basis income statement will embrace the invoiced income on your revenue assertion.

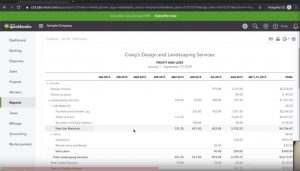

Every enterprise is completely different, so you’ve the ability to customise your stories to see the information that matters whereas accessing insightful business analytics. Half of tracking the price of goods offered (COGS) is making sure that each cost is accounted for and precisely inputted into your financials. To achieve this, you can utilize the various options obtainable via Quickbooks Online. Part of normal bookkeeping is ensuring that every one expenses associated to your business are accurately recorded. There are a number of options that may assist you with recording and categorizing all your expenses. These accounts should be every little thing that makes earnings for your small business, from sales to investment revenue.

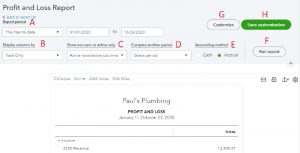

Additionally, please know that it only reveals the total quantity under that specific expense account. Nevertheless, when you’re trying to view all transactions for a selected expense account, you’ll have the ability to generate the Profit and Loss Element report. Customizing this report with filters to concentrate on the info you might be analyzing simplifies the task. Printing a profit and loss report in QuickBooks isn’t nearly paperwork—it’s about empowering your self with the financial knowledge needed to steer your small business forward. By understanding how to entry, customise, and print your report, you’re equipping yourself with the instruments to face any financial challenge head-on.

A chart of accounts is an inventory of all of the accounts available for recording transactions in your company’s general ledger or accounting software program. It is also step one in creating your accounting system and organizing your financial information. To decide what accounts need to be included in your chart of accounts, you must perceive the completely different account varieties out there. QuickBooks (QB) is a software program that assists companies with Bookkeeping, Accounting, Payroll, Stock Management, and different financial processes. You can create financial statements and reviews utilizing QuickBooks.

Choose the format you want, and QuickBooks will automatically produce the report for you. Once you generate your P&L report, then you need to review it for accuracy but in addition put it to use as a part of your financial analysis of your corporation and its profitability. To generate a report, Quickbooks On-line supplies a Reviews tab, where you probably can create the monetary statements you want for any sort of research. To perceive how one can create this P&L statement, you have to understand how your online accounting software program operates. Let’s start by looking at some of the popular accounting software choices, Quickbooks Online.

Steps To Print The Profit And Loss Report

- Enterprise owners use the P&L to grasp how much money an organization makes, which they’ll additionally quickly and simply do with accounting software program.

- A clear, optimized report isn’t just simpler to read, but in meetings, it might be the anchor that supports strong discussions.

- It’s like the report card for your small business, showing you the revenue, bills, and the way they web out to either profit or loss over a specific period.

Equally, in case your vendors invoice you and you pay them sooner or later sooner or later, these expenses are incurred as of the date of the bill, not when you truly pay it. An accrual-basis income assertion will include bills that are not yet paid in your expenses. Create and customize an income statement to fit your enterprise’s needs, then save, print or ship.

What Are The Benefits Of Offshore Accounting?

A business’s revenue and loss statement (P&L) shows its revenue, expenses, and profitability over time. Its assets and liabilities as of a selected date are proven as a snapshot on the balance sheet, however. Often, as of the final day of the business’s fiscal yr https://www.quickbooks-payroll.org/, the balance sheet is displayed. In QuickBooks, you need to go to the “profit and loss statement” when requested for an revenue assertion. Also referred to as a P&L, the revenue and loss statement is precisely the identical factor as an income statement. Neither name is more appropriate than the other, though some may argue that “profit and loss” is extra accurate because the report shows more than only a business’s revenue.

Get 2 Months Of Bookkeeping For Free!

To calculate COGS, add the cost of inventory firstly of the yr to purchases made all year long. There are other stock costing elements that may influence your overall COGS, corresponding to first in, first out; final in, first out; and average cost. Value monitoring is important to calculating the correct revenue margin of any product or service, plus it lets you calculate the true value of your stock since it’s your largest enterprise asset. To ensure that quickbooks profit and loss statement you possibly can produce accurate information in your tax submitting, it is necessary to use the same costing technique all 12 months long. QuickBooks profit and loss report mistaken happens when discrepancies happen in transactions. You may even see incorrect quantities, totals, and so forth., for numerous causes mentioned within the section under.

To construct a P&L statement on Quickbooks On-line, you should have your bookkeeping so as, otherwise, the information is not going to be obtainable to create an correct report. With that in mind, let’s talk concerning the steps you should take to find a way to be positive that your data may be interpreted accurately by the Quickbooks accounting software. QuickBooks customize profit and loss report may be accomplished for the reporting period, columns, accounting methods, and so forth. The multistep technique involves more calculations and the classification of bills. It groups the price to make services or products as prices of products offered (COGS). A revenue and loss statement (P&L) is a snapshot of an organization’s gross sales and bills over a time frame.

If you disagree with any a part of this Disclaimer, then you definitely wouldn’t have our permission to entry or use the Website. Edward Martin is a Technical Content Author for our leading Accounting firm. He has additionally labored with Sage, FreshBooks, and many other software platforms.