Adjusting the allowance for doubtful accounts is a crucial task for any enterprise that extends credit to its customers. This adjustment is not just a mere accounting formality; it is a strategic maneuver that displays the corporate’s expectations about the collectibility of its accounts receivable. Periodic evaluate of the allowance for doubtful accounts is crucial as a result of it immediately impacts the accuracy of a company’s financial statements and its understanding of customer credit score danger. The threat classification method includes assigning a threat rating or threat class to every buyer based mostly on criteria—such as cost history, credit score score, and trade.

Particular Identification Method

Understanding the significance of uncollectible accounts, figuring out their causes, and estimating their potential impact is crucial for effective management. By implementing acceptable methods and accounting practices, businesses can reduce the prevalence of uncollectible accounts and mitigate their opposed results. Uncollectible accounts can have a big influence on businesses, especially smaller ones with restricted financial assets. When an organization is unable to gather fee, it not only affects its money flow but additionally erodes profitability. Moreover, unhealthy debt can pressure relationships with clients and injury the company’s reputation.

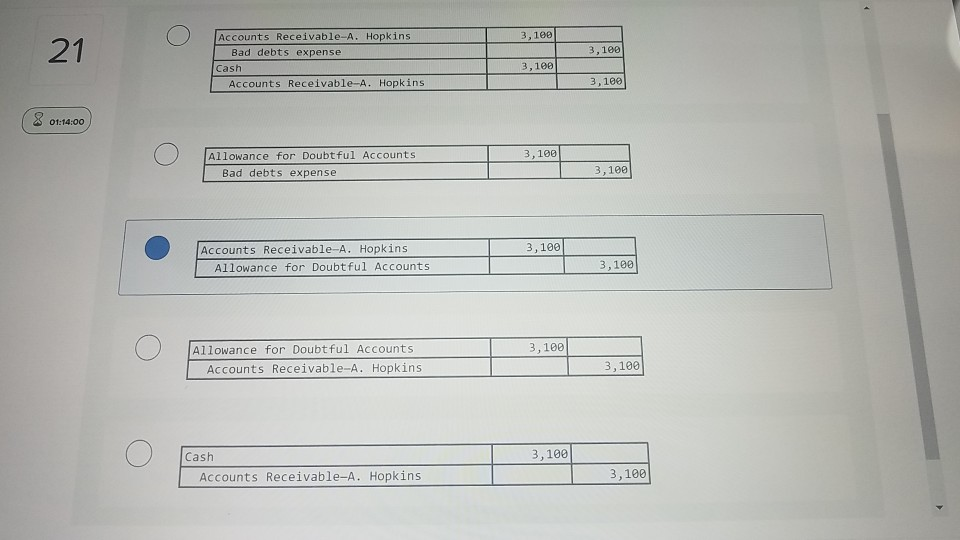

The aim is to strike a balance between being overly cautious, which may unnecessarily tie up capital, and being too optimistic, which may end in a success to earnings if actual bad debts exceed the allowance. Implementing finest practices for collecting outstanding debts is significant for managing uncollectible accounts effectively. In summary, regularly assessing uncollectible accounts is a crucial apply for companies seeking to maintain monetary stability and decrease losses. Through proactive and diligent evaluation, companies can safeguard their financial health and position themselves for long-term success. During the following year, if a buyer with an excellent balance of $6,000 defaults on cost and is set to be uncollectible, the company will make a journal entry to write down off this certain amount.

A corporation may be accumulating excessive allowances if it takes a quantity of years to exhaust its allowance for doubtful accounts receivable steadiness. Exhibit 1 uses three years of information from Dell Inc. to describe three easy methods for assessing previous estimates of the allowance for doubtful accounts. As A Outcome Of the strategies use historic knowledge, they offer an indication of the effectiveness of past estimates. As A Outcome Of the estimate can be 5%, the allowance would be estimated at $5,000 as a substitute of $7,000 and bad debt expense would also be decrease and by lowering bills, net revenue (revenue – expenses) goes up. Nothing adjustments for revenues or number of clients and the net realizable amount would be larger not lower.

- Leverage expertise and knowledge analytics to reinforce the accuracy of your bad debt estimates.

- Nevertheless, a number of different analysis strategies can provide perception regarding the accuracy of prior estimates and the effectiveness of the estimation course of.

- At the same time, the allowance for doubtful accounts is elevated on the balance sheet, lowering the web accounts receivable by the identical quantity, thereby presenting a extra correct monetary place.

- The proportion of credit gross sales methodology immediately estimates the bad debt expense and information this as an expense in the income assertion.

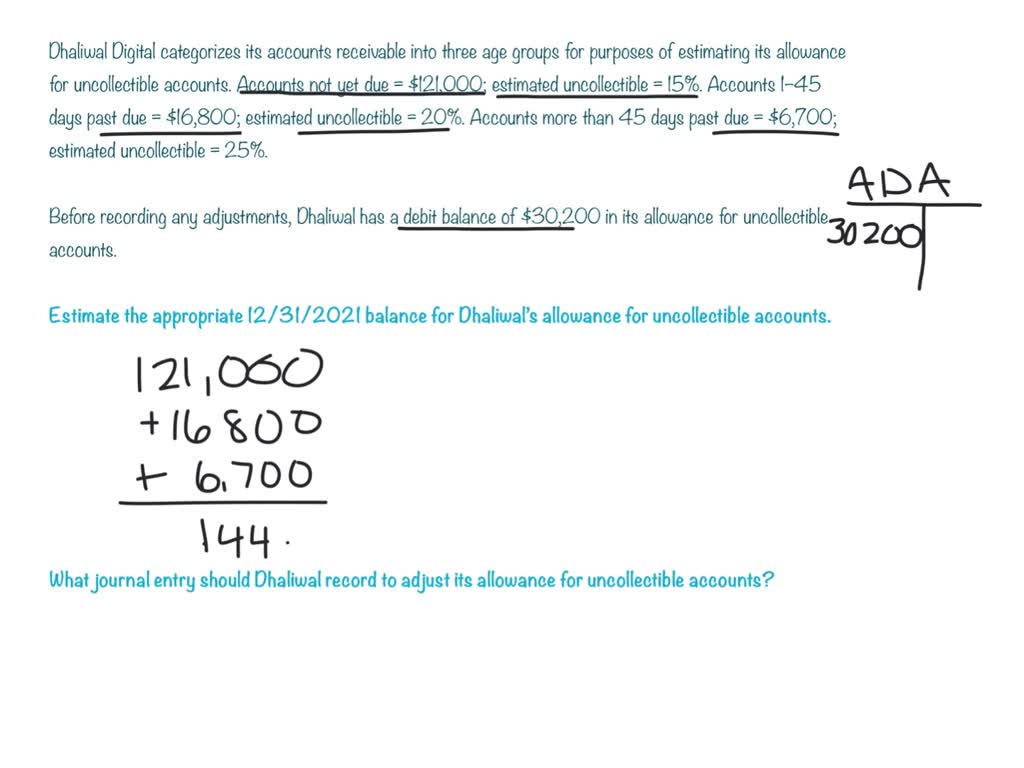

They advocate for thorough credit score checks, setting credit score limits primarily based on the customer’s fee historical past and financial well being, and common evaluations of the credit phrases provided to customers. Credit managers, on the other hand, would possibly prefer the getting older of accounts receivable method, which categorizes receivables based on how lengthy they have been outstanding. For instance, if $50,000 of receivables are over ninety days due, and traditionally 20% of such receivables are uncollectible, then $10,000 must be reserved for the allowance. The accounting journal entry to create the allowance for doubtful accounts entails debiting the unhealthy debt expense account and crediting the allowance for doubtful accounts account. The Pareto evaluation method depends on the Pareto precept, which states that 20% of the shoppers cause 80% of the cost issues.

The Way To Estimate Uncollectible Accounts Under Gaap

Understanding the nature of uncollectible accounts and their impression on financial statements is crucial for effective financial management. Estimating the allowance for uncertain accounts is a important side of managing a company’s accounts receivable. It includes setting apart a reserve for the portion of receivables that may not be https://www.personal-accounting.org/ collectible, thus making certain that the monetary statements current a realistic picture of the corporate’s monetary health. Completely Different corporations might undertake numerous strategies based on their trade, measurement, and buyer base.

The allowance for bad debt is often established by recording an adjusting entry on the end of an accounting interval primarily based on the estimated dangerous debt share. To manage uncollectible accounts successfully, businesses have to estimate the quantity of unhealthy debt they expect to incur. Firms can use historic knowledge, business benchmarks, and buyer creditworthiness assessments to make these estimates. By accurately estimating uncollectible accounts, businesses can be positive that they set aside sufficient funds to cowl potential losses. Another method to document unhealthy debt expense or uncollectible accounts in the monetary statements is by using the allowance method. This method adheres to the matching precept and the procedural requirements of GAAP.In the allowance method, a company estimates the quantity of uncollectible accounts it’s going to incur as a share of credit score gross sales.

Our tailor-made approach ensures compliance with accounting standards and offers actionable monetary insights, ultimately strengthening your financial stability and decision-making capabilities. This technique adheres to the GAAP matching principle by making certain that bills are recognized in the same period because the revenues they relate to, offering a extra correct financial image. The Allowance for Uncollectible Accounts or Allowance for Doubtful Accounts is a contra asset account that reduces the amount of accounts receivable to the amount that is extra probably be collected.

This allowance supplies a sensible measure of a company’s accounts receivable, bettering money flow administration, compliance with accounting requirements, and general financial stability. By estimating uncollectible debts, businesses can better prepare for potential money shortfalls and preserve more accurate monetary data. In the retail trade, corporations typically face high volumes of accounts receivable because of credit gross sales to customers. A well-known retailer, XYZ Retail, carried out a complete credit management system that included automated invoicing, reminders, and an aging evaluation tool. By leveraging technology, XYZ Retail was capable of cut back its average assortment period from 45 days to 30 days, significantly lowering the chance of uncollectible accounts.

The investor, on the other hand, may see the allowance as a sign of the company allowance for uncollectible accounts‘s threat exposure and administration’s confidence in its credit controls. Writing off bad debt involves removing the specific customer’s outstanding stability from the accounts receivable and decreasing the allowance for bad debt accordingly. This action doesn’t eliminate the corporate’s legal right to pursue collecting the debt; somewhat, it reflects the fact that the debt is unlikely to be recovered. Writing off bad debt is essential for maintaining accurate financial records and stopping an overstatement of property and revenue. Dangerous debt refers to the sum of money that a company is unable to collect from its customers.

The reason is that it is the first year of company’s operation and there does not already exist any allowance for doubtful accounts. When particular accounts are deemed uncollectible, they’re written off towards the allowance for uncertain accounts. The function of bearing in mind unhealthy money owed is to try to guess the whole amount of unhealthy money owed that you just’re likely to incur in the course of the tax 12 months. Unfortunately for various causes, some accounts receivable will remain unpaid and will need to be offered for within the accounting records of the business.